- Jay Parsons' Rental Housing Economics

- Posts

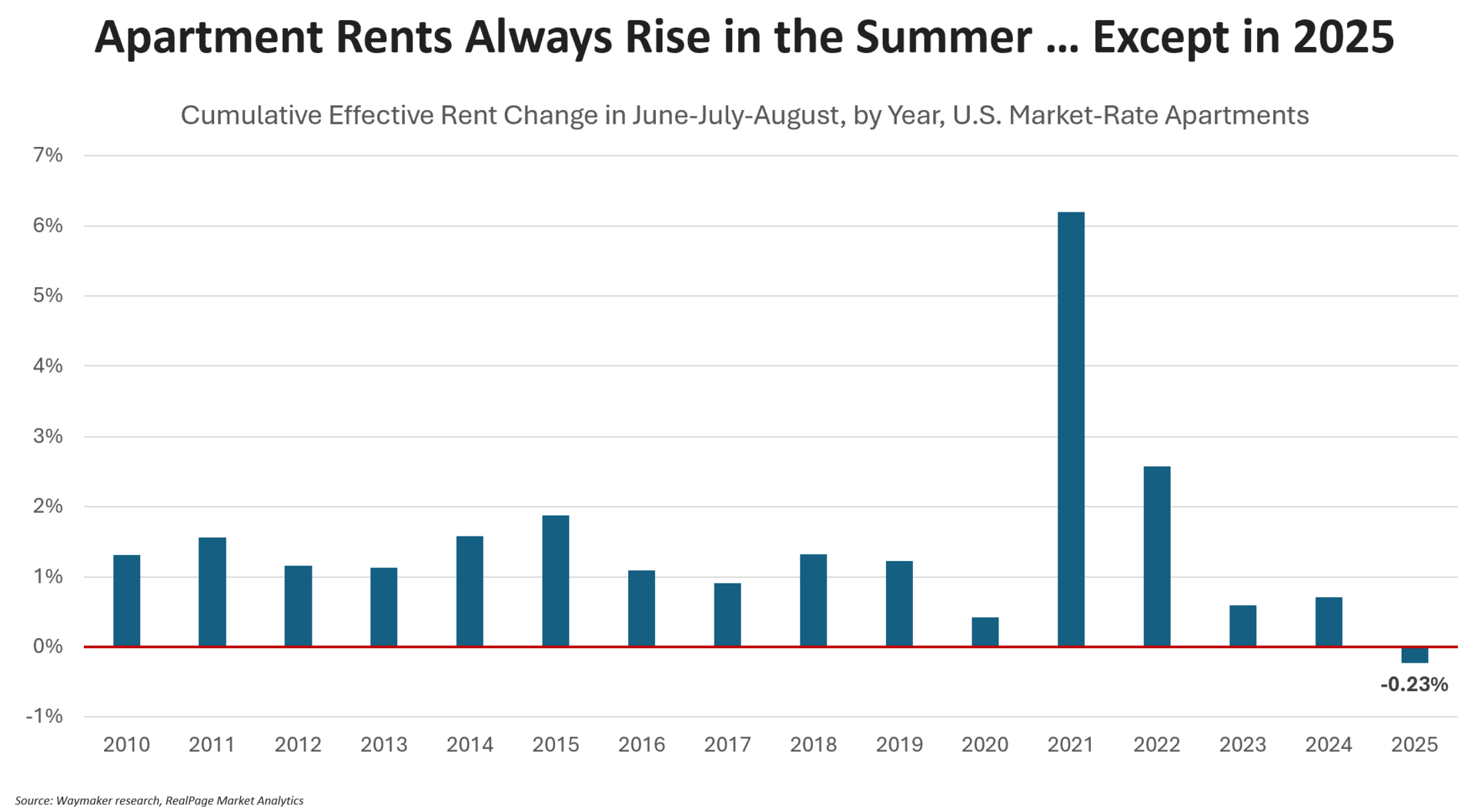

- September Multifamily Update: Farewell to the Softest Summer in 15+ Years

September Multifamily Update: Farewell to the Softest Summer in 15+ Years

Will the apartment market improve in the fall? How is the softening economy impacting apartment demand?

Mercifully, Monday brought the official end of summer, the autumnal equinox marking a new season – fall.

Apartment owners and operators can only hope fall proves better than the summer. Because it was a rough summer for the multifamily market.

Effective rents over the combined core summer months (June-July-August) fell for the first time since the Great Financial Crisis. It wasn’t an especially deep cut (-0.23%), but it’s a stark departure from the normal seasonal pattern of +1% or so. Part of that rent softening came via concessions – even in stabilized properties, with average discounts soaring to the highest level (around 6 weeks “free”) since the early 2010s.

What’s going on? We’re a broken record at this point, but supply is obviously the main driver. Completions peaked in 2024, but much of that arrived late in the year – shoving a historic-sized wave of lease-ups into 2025. On top of those, the 2025 supply totals look very large in comparison to any recent year other than 2024. It’s a lot.

So … Is It the Economy?

First, let’s not dismiss some key details that should be early indicators of a demand-side slowdown: Not only is absorption strong, but retention rates remain high and renewal rent growth remains solid. We aren’t household consolidation, a flight to affordability, and higher turnover — all traditional signs of a demand-side slowdown.

(continued below)

However, we must acknowledge more signs of jitteriness in the economy.

Job growth slowed to just 22,000 jobs added in August.

Revised numbers showing actual job losses (-13,000) in June.

Fed chair Jerome Powell called it an “interesting labor market” right now, noting that “kids coming out of college and younger people, minorities – are having a hard time finding jobs. The overall job finding rate is very, very low. However, the layoff rate is also very low. So you've got a low – a low firing, low hiring environment.”

Of course, the “kids coming out of college and younger people” demographic is an especially important one for apartments.

At the same time, every data provider has – at least so far – continued to show very strong net absorption numbers. Some of that is propped up by low turnover (including renters renting longer due to challenges buying homes), but that doesn’t explain all the net new demand. (The Q3 absorption numbers will come out in a couple weeks.)

But you can’t help but wonder if absorption would be even stronger if more recent college graduates quickly found jobs. That would certainly be a logical assumption.

The upside: As Powell noted, there’s also not a lot of layoffs. Unemployment is still low, even if up slightly. So maybe employers are just nervous, as are consumers. Maybe confidence returns, job growth returns, and we see some pent-up demand for apartments released among recent college graduates – boosting the post-supply rebound story for multifamily. Or so we can hope.

More Highlights

Yardi says “this deceleration is driven by supply rather than demand, as elevated deliveries have created a highly competitive leasing environment amid record absorption.” But also adds that “operators are concerned that it will soften through the second half of the year” due to a softer job market.

RealPage data shows year-over-year effective rents falling (-0.2%) for the first time since early 2021. Apartment List reported rents down 0.9% in their data. By comparison, CoStar and Yardi still show slight rent growth.

CoStar reported two straight months of “flat or negative national monthly rent change,” and noted all four regions of the country recorded month-over-month rent cuts in August.

Yardi writes that “if the pattern holds, rents will change little in coming months.” So all eyes are on spring 2026.

Radix called the multifamily market “steady” and “in line with recent reports,” with minimal rent growth coupled with stable leasing traffic and occupancy.

CoStar reports that apartment construction is “plummeting nearly 50% from its peak” in the Sun Belt.

San Francisco remains a notable exception to the rent slowdown rule, as it continues its rebound following nearly five years of softness. RealPage and CoStar and Apartment List all ranked San Francisco as the #1 major market for rent growth in August. Yardi ranks Chicago as #1 and San Francisco at #8.

Apartments.com did a big survey of cohabitating renters, and found (among other things) they’re far more likely to move-in together because of relationship status than to save money on rent.

— My Latest Posts on LinkedIn —

Here are some recent posts if you missed them:

New academic research shows that when cities/states pass tenant protections like “just cause evictions” and right-to-counsel, renters bear the burden of higher rents.

The single-family rental market is doing fine … but it’s not seeing the big boom that some pundits (not us!) expected when homebuying stalled out.

Another huge deal: Kennedy Wilson is buying the Toll Brothers’ Apartment Living platform — development team and all.

Greystar’s new head of property management said that in some markets, “50% of our applicants are fraudulent.”

Thoughts on the Fed’s rate cut and Chair Powell’s comments on housing.

A new survey from two national construction trade groups shows that more than 1 in 4 contractors say they have been "affected directly or indirectly" by stepped-up immigration enforcement.

Not all data sources are equal. Occasionally, we see headlines based on data that doesn’t align with most data providers.

We aren't talking enough about how the largest component of CPI -- shelter (i.e. rents) -- continues to cool off, even as other categories heat up a bit.

The nation’s next big rent control push is coming to Massachusetts.

The number of renters making $1 million+ in income has tripled since 2019.

We’re giving the stalled-out homebuyer market too much credit for low turnover.

Maybe the most interesting stat in 2025 so far? AvalonBay bought in suburban Texas at a cap rate reported to be in the high 4s, while selling similar-ish vintage assets in D.C. at a cap rate the buyer said was high 5s. (Initial post: AvalonBay is selling 1,248 units in Washington, D.C., to Foulger Pratt.)

No, apartment starts are not surging back up … even if the Census says otherwise.

Here’s where apartment concession values are highest.

Here are the top 20 fastest-growing submarkets for new apartment supply.

— Now Spinning on The Rent Roll Podcast —

The Rent Roll with Jay Parsons podcast continues to frequently rank in the Top 100 podcasts on Apple’s charts for investing-themed podcasts, and was recently ranked as the third-best podcast in commercial real estate by the readers of CRE Daily! Thank you for helping us grow so quickly. New episodes are released every Thursday morning.

*DROPPING THURSDAY* Episode 52: Q3’25 SFR Update & Outlook with Invitation Homes’ Scott Eisen

Episode 51: Rate Cuts & Pro-Housing Policy with the Terwilliger Center’s Dennis Shea

Episode 50: Multifamily Capital Markets Update with MSCI’s Jim Costello

Episode 49: The Dealmaker Who Scaled Everest with TruAmerica’s Matt Ferrari

Episode 48: The “Big Beautiful Bill” and Rental Housing with Novogradac’s Michael Novogradac

Episode 47: What are LPs Looking for Right Now? with Trinity Investors’ Dan Meader