- Jay Parsons' Rental Housing Economics

- Posts

- Apartment REITs Earnings Call Recaps, Part 2

Apartment REITs Earnings Call Recaps, Part 2

Highlights and market color from MAA, UDR, IRT, Centerspace, Elme and Clipper

Sponsored by: Madera Residential and JPI

This is the second in a series recapping highlights from Q4’24 earnings calls among the rental housing REITs. Today’s edition covers two more of the Big 6 apartment REITs: MAA, UDR — plus mid-sized and smaller REITs of Independence Realty Trust (IRT), Centerspace, Elme Communities and Clipper Realty. Part 1 (which you can find here if you missed it) covered AvalonBay, Camden, EQR and Essex. The third edition (late next week) will cover the single-family rental REITs plus the remaining small apartment REITs. (INVH is the last to report this quarter, on Feb 26.)

One more shameless plug before we dive in: Check out The Rent Roll with Jay Parsons podcast for more on the REITs on your streaming platform of choice (Spotify, Apple, YouTube and Amazon). Last week’s episode features a Top 5 takeaways on the big apartments REITs’ earnings call plus a conversation with Camden CEO Ric Campo. This week’s episode touches on a few REIT topics but focused on how some institutional investors are adding or expanding debt funds — hoping to find better risk-adjusted returns. Our guest this week is Dan Walsh, CEO of Citymark Capital, who talks about how his company sold apartments back during the peak and is now switched gears to buy loans from banks and debt funds.

***Lastly: As always, this commentary is not investment advice (nor should it be interpreted as such) — just stuff I found interesting.***

MAA

National portfolio with >104k units, primarily Sun Belt

1) New supply continues to push down rents (-8% YoY on new leases) but “the tide is starting to turn,” with construction trending down fast and demand remaining robust, eventually (not immediately) resulting in "significant impact on market rent growth." Still forecasting modest rent cuts for 2025 (for new leases), so that comment appears pointed toward 2026.

2) Optimism stems not only from reduced supply, but strong demand. Like others, MAA has heavily prioritized "heads in beds" / occupancy over rents, but now see some momentum (i.e. "less negative") on rents.

3) Occupancy is improving, retention remains high, renewal rents steadily increasing (4s) and renters continue to pay rent on time -- with numbers even improving in Atlanta, which had been payment laggard due to fraud issues there.

4) Smaller/mid-sized markets like Richmond, Norfolk, Charleston and Greenville are generally outperformers for MAA, which also highlighted strength in DC area and Houston ... plus strong improvement in Tampa and Orlando. Laggards: Austin, Jacksonville, Atlanta.

5) MAA expects another year of new lease rent cuts in 2025 (-1.5%) but much less than 2024, while renewals expected to grow by 4.25-4.50%.

6) Like others, MAA doesn't think immigration policy will have any impact on occupancy rates or rents. However, MAA did note that policy (presumably potential deportations) could be impactful on their construction business, limiting their ability to "ramp up."

7) Speaking of construction, MAA (like other REITs) has made a point to zig when private developers zag -- ramping up construction thanks to lower cost of capital and conviction on 2026+ low supply. Noted record starts for MAA in 2024, and another 3-4 starting in '25. “Development is one of the best uses of capital that we have today.”

8) MAA reported a bit of improvement on construction costs (4-5%), mostly from labor cost reductions. MAA also noted they need to see more cost cuts and/or rent growth in order for "more (projects) to begin to pencil."

9) MAA is also buying recently built apartments still in active lease-up (meaning they're not fully occupied yet), which is unusual b/c usually buyers wait until stabilization when projects are eligible for Fannie/Freddie financing. But likely gets MAA ahead of the line.

10) MAA also going against the grain a bit on the construction lease-up strategy (likely due to lesser capital pressures than merchant builders) holding "firm on our rent pricing expectations" even if it means taking longer to lease up.

11) MAA is looking to expand its presence in Denver and Salt Lake City, and also eyeing Columbus as a new market. Meanwhile, MAA may exit a few markets where they have only 1-2 assets -- favoring markets where they can build more scale (and therefore efficiency).

12) Lastly: MAA's long-time, CEO, Eric Bolton participated on his last earnings call before handing over the job to Brad Hill.

UDR

National portfolio with 60k units

1) Still prioritizing occupancy over rent, but positioning for rent growth. The strategy to focus on occupancy in Q4 puts UDR “in a position of strength as we enter our traditional leasing season.”

2) UDR is starting to pull back concessions (rent discounts on new leases), and some of the initial rent rebound in 2025 could come via concession burn-off.

3) UDR gave some very insightful detail on how they think about the balance of occupancy and rent. A lot of people just assume REITs always want higher rent, but it's not that simple. REVENUE matters more than rent, and revenue is rent+occupancy. Vacant unit = zero revenue.

4) Like its peers, UDR reported the East Coast as its best performing region -- and expects that to remain the case in 2025 (led by NYC and DC). Increasingly bullish on San Francisco, Seattle and OC, too. Soft on Monterrey Peninsula, where rent control recently enacted.

5) More specifically on Monterrey area (south of San Jose): UDR said they're no longer able to bill residents for utilities until they add submeters -- amounting to a $2-3m "drag for us in 2025." Will eventually add submeters.

6) UDR expects the Sun Belt to be flat to modestly positive on NOI in 2025, largely due to supply competition in Nashville and Austin. Like its peers, UDR is feeling more bullish on Tampa and Orlando.

7) Renter turnover has been low throughout the industry, including for UDR -- which reported 21 straight months of YoY growth in retention. UDR is expecting more improvement in 2025, amounting to $3.5m boost to cashflow. (Occupancy = revenue)

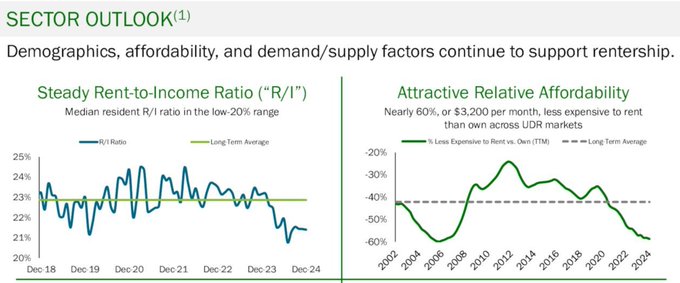

8) Like its peers, UDR sees affordability re-emerging as a tailwind. Rent-to-income ratios are now BELOW pre-COVID levels. And renting remains substantially discounted relative to buying.

9) One factor in improved renter financial health: Stronger tech to weed out applicants using stolen or synthetic IDs and then not paying rent -- "making sure we're identifying bad actors" before move-in. Also: Applicant credit scores up 20 bps to nearly 730.

10) UDR has been mostly on the sidelines of late when it comes to new development, but said they now plan "maybe two to three starts" in 2025. Not quite as bullish on construction as AVB or MAA, but still a step forward.

11) UDR is seeing some positive trends on construction costs -- especially on labor. But concerned about impact of tariffs on materials like lumber, mechanicals and glass.

12) Asked about potential for an industry-wide resurgence in starts, UDR pointed out that would be highly unlikely. (Remember: REITs can ramp up when most builders can't b/c of cheaper cost of capital and long-term horizon, but REITs represent tiny share of construction.)

13) UDR pointed out that while investors/buyers are bullish on apartments, so are sellers -- and that means few assets coming to market. UDR did say they're looking to acquire 20- to 30-year-old properties with value-add upside.

14) Like others, UDR is seeing strong growth from ancillary programs like rolling out bulk WiFi (which typically provides residents with discounted internet + revenue boost for owner).

15) Lastly: UDR called their 2025 outlook "slightly conservative" due to "macro uncertainties such as immigration reform and regulatory risk," counterbalancing (to some degree) stable demand and falling supply.

Independence Realty Trust (IRT)

Midwest and Sun Belt portfolio with 33k units

1) Surprisingly, IRT says they have a "fulsome pipeline" of acquisition opportunities — a far more bullish tone than we heard from other REITs or from peers on the private side. One nuance: IRT is targeting not only lease-ups (like a lot of players both public and private) but also value-add Class B (older properties ripe for renovations). Most other REITs are more focused on buying Class A. Higher cap rates in Class B (mid 5s) vs Class A (4s), and IRT says they're starting to see some distress there.

2) IRT acquired three properties in 2024 (in Charlotte, Tampa and Orlando) and is under contract on a fourth (in Indianapolis). Those first three are already REIT-favored markets, and Indy has become increasingly interesting among institutions but not yet among REITs.

3) Related to value-adds, IRT reported "notable progress" in current program -- with 1,671 unit renovations resulting in $239 average increase and 15.7% return on investment.

4) On fundamentals, IRT reported solid occupancy gains in 2024 (up 110 bps), 62.7% renewal rate and 1.3% in blended rent growth (like others-- new lease rents fell, while renewal rents increased).

5) Like its peers, IRT expects declining supply competition to result in "greater pricing power without sacrificing occupancy in 2025, a dynamic that should accelerate during the year and as we advance into 2026."

Centerspace (CSR)

Midwest and Mountain West portfolio with 13k units

1) Occupancy climbed 70 bps YoY to "one of our highest Q4" rates on record at 95.5%. Same-store revenues up 3.3% YoY. Like others, Centerspace saw revenue growth lifted by healthy renewal increases while new lease rents fell in Q4.

2) Centerspace reported strong resident financial health -- "lower than national average rent-to-income ratios and low bad debt (unpaid rent)." Also reported low competitive supply in most of their markets, aside from Denver and Minneapolis.

3) Top markets for Centerspace were North Dakota, Nebraska and Rochester (MN) -- three markets pretty much off the radar for other REITs and most institutions.

4) The more institutional-grade markets of Denver and Minneapolis remained softer spots for Centerspace (and others) due to more competitive new supply -- especially in Denver. Centerspace said Denver might not see "more defined tailwinds" until 2026.

5) Centerspace still likes Denver long term (and just bought another property there). But overall, like most other REITs said, acquisitions remain tough given high interest rates and seller expectations on pricing. "The bid-ask spread is real."

Elme Communities (ELME)

DC and Atlanta portfolio with 9,400 units

1) Unhappy with a stock priced below perceived net asset value, Elme hired JLL and Goldman Sachs to "evaluate strategic alternatives." Elme was careful not to promise any particular outcome (a potential sale being one), but the announcement likely led to plenty of pencils breaking out to give it a look.

2) Elme has about 7k units in the DC area and, so far, sees no sign of slowing leasing demand tied to reductions in the federal workforce. Notable: Elme reported only 6.2% of their DC area residents work for non-DoD federal agencies and only 4% work for federal contractors.

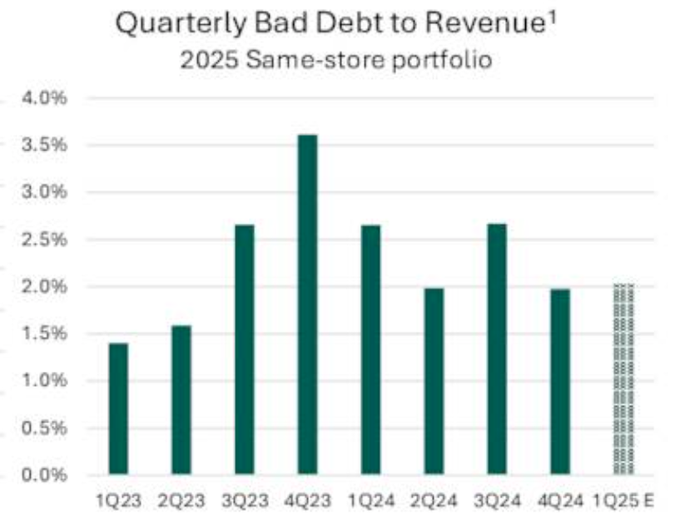

3) Atlanta has been a much tougher market for Elme (and others) in recent years due to high supply competition and weak rent collections tied to leasing fraud. But Elme reported gradually waning supply headwinds + improved rent collections in Atlanta area.

4) More on bad debt (unpaid rent): Elme showed bad debt to revenue fell over the last year from ~3.5% in Q4'23 to 2.0% in Q4'24.

5) Overall, Elme reported blended rent growth of 1.8% as of January, combined with high retention rates -- in part due to "very low" move-outs to home purchase. Also reported healthy renter base with rent-to-income ratios of 22% in Atlanta and 23% in DC.

Clipper Realty (CLPR)

Apartment REIT with about 10 properties all in New York City

1) Like the bigger REITs, Clipper is seeing high occupancy rates and above-average rent growth in New York City.

2) Clipper has two new construction projects, one now fully leased and the other nearing completion.

3) Clipper has in recent quarters talked about ongoing issues with its massive 2,500-unit Flatbush Gardens property in Brooklyn. Reported some mixed news in Q4, but rent collections remain low there (88-92%) compared to 97% for portfolio.

More on REIT Earnings Season:

If you missed Part 1 in this series (covering earnings call highlights from AvalonBay, Camden, EQR and Essex), you can find here.

The third edition (late next week) will cover the single-family rental REITs plus the remaining small apartment REITs. (INVH is the last to report this quarter, on Feb 26.)

As a reminder once again: None of what I write about REITs (or otherwise) is intended to be investment advice whatsoever, nor is it a comprehensive look at any REIT. I just write about the things I find interesting.

***Now Spinning on the Podcast***

The Rent Roll with Jay Parsons podcast continues to rank in the Top 100 podcasts on Apple’s charts for investing-themed podcasts. Thank you for helping us grow so quickly after just 21 episodes! Find us on Spotify, Apple, YouTube and Amazon.

Episode 21 last week covers the five big themes from the apartment REITs’ Q4’24 earnings calls — plus an interview with Camden CEO Ric Campo. And Episode 22 dropped today with Citymark Capital CEO Dan Walsh, talking about traditional multifamily equity players expanding or adding debt funds. We’ll have an episode on SFR coming up after the two big SFR REITs report earnings.

Recent Episodes:

Episode 17: The Re-Rise of the Sun Belt with Knightvest Capital CEO David Moore

Episode 18: Build-to-Rent Update with the BTR King, Redwood Living CEO Steve Kimmelman

Episode 19: How Demographic Shifts Impact Renting, with Chris Porter, SVP at JBREC.

Episode 20: NMHC Buzz and Midwest Love with BAM Companies CEO Ivan Barratt

Episode 21: Apartment REITs’ Earnings Recaps with Camden CEO Ric Campo

Episode 22: Is Debt the Nee Equity? Sort Of, with Citymark Capital CEO Daniel Walsh